Global creators’ royalties expected to decline by up to 3.5 billion euros in 2020

CISAC report shows the impact of COVID-19, the actions of authors societies and the support needed from governments

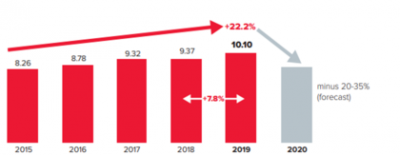

Paris – 28 October 2020 – Worldwide royalty collections for creators of music, audiovisual works, visual arts, drama and literature are likely to decline this year by up to 35% – or €3.5 billion in lost income – according to the latest annual Global Collections Report published by CISAC (International Confederation of Societies of Authors and Composers).

The report, titled “COVID-19: Crisis, Resilience, Recovery”, shows how creators have been impacted by the pandemic and analyses the continuing effects on their income well into 2021. It documents the actions taken by CISAC’s member societies to mitigate the damage through case studies of societies in Australasia, Brazil, Colombia, France, Morocco, Norway, Spain, the UK and the US.

The Report also highlights creators’ resilience and the need for further government measures to support the creative sector. Highlights at a Glance of the full report are available here.

Data estimates

Creators need a level playing field

Commenting in his introduction to the Report, CISAC President Björn Ulvaeus says: “Today, uncertainty about the future for creators is even worse than it was when the pandemic first emerged. Millions of creators are losing their livelihood. We were the first industry to be impacted and we will be the last to return to health.

“Creators are innovative, entrepreneurial, and resilient, but to build a long path out of this crisis, we have to turn to governments. This is not just for emergency funds; however welcome those have been. Policymakers also need to tackle the problems in front of them: the deep flaws that have skewed the playing field for creators for many years. COVID-19 did not create this skewed level playing field. But it has sure aggravated and exacerbated it. This is the time for governments to show they take creative industries seriously. It is time for policymakers to wake up and act”.

In his foreword, CISAC Director General Gadi Oron says: “Looking ahead, this Report reflects extraordinary resilience across our sector, but not yet recovery. Things will get worse for creators before they get better, with loss of collections in 2020 translating into reduced distributions in 2021. In this crisis, CISAC’s member societies have acted to defend their creators with all means available. While the current crisis is exposing the deep fragility of the collective management system, it is at the same time showing the vital importance of its work for creators”.

CISAC Board Chair Marcelo Castello Branco says: “This year, we have all been caught in a perfect storm. The coronavirus pandemic has thrown into reverse our global growth, and its effects will be felt throughout 2021 and 2022. This troublesome period is clearly not over – but it is fair to say we are all building bridges to whatever comes next while staying positive and alert to future opportunities and challenges. We must now battle to stay in the game and be ready to support, represent and pay our right holders what they deserve and expect from all of us”.

Further data highlights

- Royalties from concerts, venues and public performances have borne the brunt of the pandemic and are forecasted to decline by 60-80% in 2020. New licensing innovations, such as live streaming of works, are helping support digital revenues, but these fall far short of compensating for the losses from other uses.

- Music income for songwriters and composers makes up the majority of the total and is set to fall between €1.8 and €3.1 billion in 2020, also a decline of 20-35%.

- The impact of the pandemic is expected to remain long into 2021 and beyond. Across all repertoires, collections in 2021 will remain below the level of those in 2019, with users continuing to face payment difficulties and bankruptcies.

- Collections for 2019 grew by 7.4% to hit €10 billion for the first time. Music collections grew 8.4% in 2019. The losses of 2020 – for music only and for all repertoires combined – are set to wipe out five years of growth since 2015.

Download Key Highlights of the Report

Download the full Report